The Merchant Cash Advance (MCA) industry has experienced significant expansion over the past decade - innovating within financial services while adjusting to new regulatory frameworks. Continuing to serve the underserved, MCA is a fully dynamic product and while many are worried about its future, there’s confidence it’s here to stay for the foreseeable future. Here are some numbers: the good, the bad, and the future.

The reported growth of the MCA market, poised to hit nearly $26.3 billion by 2029, signals a robust trajectory. However, this expansion is not without its faults. While MCAs provide crucial working capital to owners unable to obtain traditional funding, they often tether borrowers to high-cost debt cycles due to their structure, which demands at times, a gross percentage of future sales, often at high rates. However, the high rates have not been the issue seen of late.

ISOs: Their Vital Role

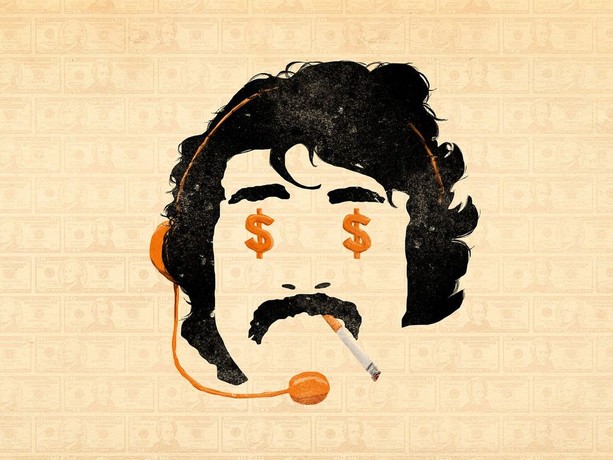

Independent Sales Organizations (ISOs) are crucial to the MCA ecosystem. They play a critical role in connecting businesses with capital providers, often acting as the first point of contact for small business owners navigating the complex world of alternative financing. The most established and reputable ISOs bring a wealth of experience, trustworthiness, and a deep understanding of financial products, which are invaluable to lenders and borrowers. However, this critical role is sometimes overshadowed by less experienced ISOs entering the market. These newcomers can lack the understanding of financial principles and ethical considerations, potentially leading to situations where business owners are not fully informed about the terms and repercussions of their financial decisions.

The amount of predatory tactics that have arrived over the last few years is by far the most concerning aspect of the industry. It’s the consistent manipulation of merchants promising products and services that have not been approved by any lender/funder. This misleading angle will only continue to hurt the reputation of this space and will bring more eyes from local cities and governments to further investigate MCA in its entirety.

Transparency, Ethics, and Regulation

MCA is being undermined by practices that edge towards predatory. While many funders have contracts that include disclosures, concise repayment schedules, and overall funding terms on the first page of each contract, we are still at the helm of the ISO’s controlling the narrative with merchants. Lenders rely on them to provide transparency with those borrowers and in many cases, ISO’s are flat-out misguiding the merchant. Many great ISO companies are successfully funding within their network of lenders and are handling themselves with high integrity, transparency, and leveraging technology. However, because of the popularity of this space, it’s welcomed newcomers and smaller companies seeking to make a fast splash into the space by using these predatory tactics that will ultimately hurt not only lenders but also themselves for future client retention.

Furthermore, adherence to best practices must be more consistent than shown. It should be a mandatory framework that guides all operations, from how ISOs learn the business and are incentivized, to how they interact with clients. Ethical behavior should be the cornerstone, not an afterthought.

Thoughts Going Forward

The future of the MCA industry hinges on its ability to reform. Lenders should embrace forming more of an alliance than shown currently and in the past. Lenders and top brokers must stay ahead of the curve of current predatory practices, inevitable regulation, and security challenges. There’s an opportunity to work together to self-regulate and improve practices. This means prioritizing responsible lending practices, ISO transparency, and ensuring data protection. The future of MCA is bright, however instead of only competing, companies should work together to combat the issues that are on the battlefield right now.